Do you have low credit scores or little to no credit history?

Are you looking for the fastest, easiest and best ways to build credit in 2021 and beyond?

Then look no further, this article is for you.

We’re gonna walk you through the very best tried and tested methods for improving your credit score.

So, whether you’re just starting out in life or you’re trying to overcome bad credit, the information below will help you to build up your credit score.

Which means that you can enjoy more financial freedom.

Ready to get going?

Let’s do this.

Table of contents:

How to build credit with a credit card:

- Get a secured credit card:

- Get a regular credit card.

- Get yourself authorised user status.

How to build credit without a credit card:

- Get a credit builder loan.

- Use a co-signer.

- Get credit for paying your bills.

Final thoughts: fostering good credit habits.

How to build credit with a credit card.

Whether you have bad credit or no credit at all, by far the best way to build credit from nothing is to use a credit card.

The clue’s in the name people!

But which credit card do you go for?

Well, that’s going to depend on your situation.

There are lots of credit card companies out there that offer special credit cards for those wanting to build up their credit.

Here are your options when it comes to building up your credit score using the plastic fantastic method:

1. Get a secured credit card.

If you are a student and you’re just starting out, then the best way to start to build your credit is to get a secured credit card.

Secured credit cards can also be used to rebuild bad credit, but their main purpose is to get young folks with no credit history on the credit score ladder.

If you have a secured credit card, it basically means that your credit limit and your account balance are roughly the same.

To get approved for a secured credit card, you’ll need to have money in your bank account that matches the credit limit you want.

Secured credit cards are very easy to get your hands on because they are very low-risk.

From the card companies point of view, you are only “borrowing” what you already have, and the only risk is that you will withdraw the funds from your account (something which would obviously set off a red flag down at the bank).

Using a secured credit card is pretty much the same as using a regular one.

You use the card to buy things, pay the bill when it arrives (don’t forget to pay before the due date or you could hurt your credit rating!) and if you don’t pay on time you will be charged interest.

You will also get your cash back if you decide to close down the credit card account.

There are lots of options when it comes to secured credit cards, some offer better deals than others on the interest and annual fees, so it’s a good idea to do a comparison.

2. Apply for a regular credit card.

If you have build up a little bit of credit already, you can skip the secured cards and apply for a regular credit card.

If your credit history is limited, you can maximise your chances of being approved by going for a low credit limit.

Make regular small purchases and pay your credit card bill religiously and you’ll soon build up a good credit score.

You can (and should) ask for an increase on your credit limit once you have established that you are a responsible credit card user.

Look for a card that has low-interest rates (just in case you can’t pay it back one month).

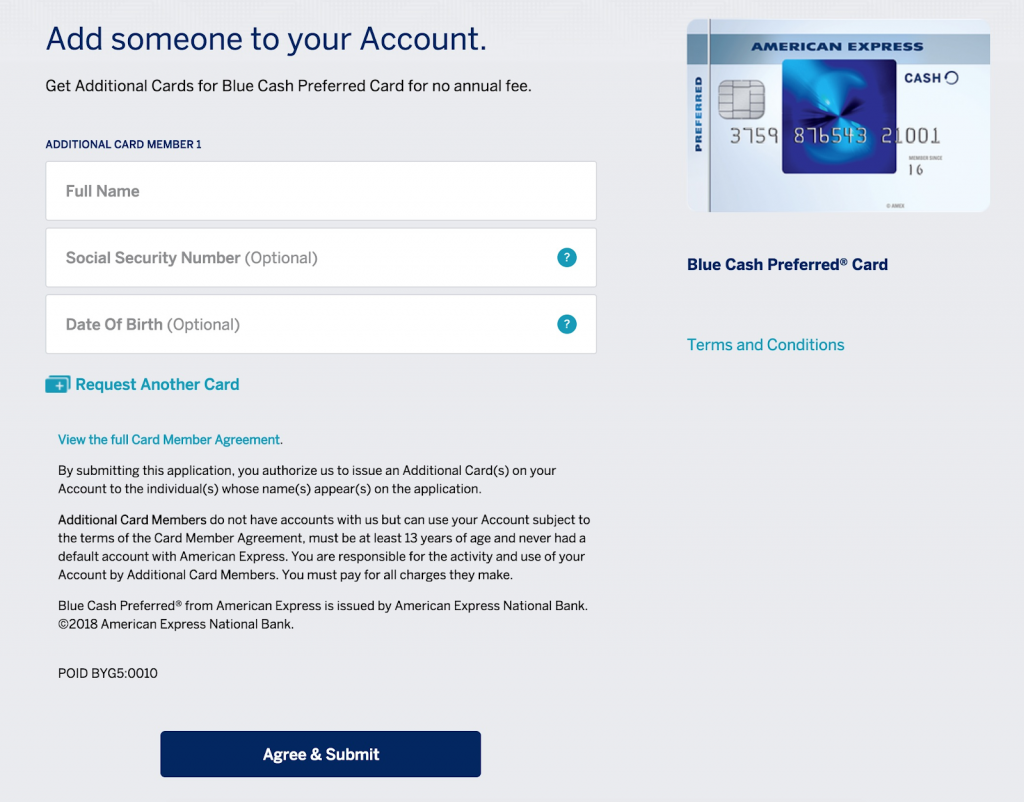

3. Get yourself authorised user status.

Did you know that you can actually get a small credit boost just by being added as a user to someone else’s credit card account?

This is a great way to build up a bit of credit providing that you can convince someone (like a parent or family member) to let you become an authorised user on their account.

They don’t have to give you their credit card and you don’t have to use it either.

All they need to do is go online and add you as a user.

By becoming an authorised user, what you are doing is adding that person’s payment history to your credit files, so this strategy will only work if the person who lets you use their account has a good credit score and a history of paying on time.

How to build credit without a credit card.

Using a credit card is by far the best method of building credit, but if you don’t want to use one, here are some other credit boosting strategies you can try:

4. Get a credit builder loan.

A credit builder loan is a special type of loan designed to help people improve their credit scores.

It works in a similar way to a secured credit card.

You borrow the money, the lender keeps hold of it, and you pay it back (plus interest).

The money is then yours to keep.

This type of loan is most often given out by credit unions and community banks.

Your repayment information will be sent to the main bureaus, thus increasing your score.

5. Use a co-signer.

If you’re worried about getting accepted for any type of loan, you can always use a co-signer.

A co-signer is someone (usually someone with good credit history and/or some form of collateral) that can act as a guarantor.

Your co-signer will be responsible for paying back any money borrowed if you default on your payments.

Cosigners are typically parents but they can be almost anyone provided they have a good credit history (and they trust you)!

6. Get credit for paying your bills.

Did you know that there is a way to get credit for paying your rent and your cell phone bill?

Rent and other common bills (like cell phone bills) don’t typically get put on your credit report, but that is now changing.

There are now several rent reporting companies out there like Renttrack and Rental Karma that can help you to get your rent and utility bill payment history taken into account.

With these agencies, you can add up to 24 months of rent payment history to your credit report, which can increase your credit score by approximately 40 points (on average).

A lot of people who don’t have a long credit history do have a history of paying their rent on time, so if you are one of those people this can really help to give your credit scores a boost.

It is an up and coming thing though, so still isn’t recognised across the board.

You’ll have to do some research to find out which lenders and agencies accept rent and bill reports as proof of good credit history.

Once you are in and have built up a little more credit, you can then progress to using any credit card you wish, regardless of whether they accept rent payments as proof.

Final thoughts: fostering good credit habits.

Building up a good credit score takes time and diligence.

It’s super important to get into good habits early on.

If you pay your bills on time, (all your bills not just credit cards), avoid maxing out too many cards, and minimise the number of applications you make for credit, you should find that your credit score will gradually increase, making it easy for you to get loans, mortgages and apartment rentals.

Let us know in the comments below which of the 6 strategies you like best!