Looking for some Tweetable, Gramable, Facebookable facts about the shocking state of student loan debt?

We’ve got you covered.

We’ve scoured dozens of scholarly articles to find the most shocking and relevant student loan statistics for 2020, so you don’t have to.

All of the following facts, statistics and infographics are taken from reputable sources such as reports issued by the Federal Reserve, Pew Research Center, CollegeBoard and the Center for Microeconomic Data.

So, whether you want to raise awareness of the current student debt crisis, or just familiarise yourself with some of the facts, you should check out our list below.

Student debt – what’s the 411 in 2020?

In 2020 more Americans are going to college than ever before.

You might be thinking “well that’s great, aren’t we a bunch of super-smarty pants” but with rising attendance figures comes rising debt.

The idea of taking a summer job to cover a large portion of your college tuition, while once a viable option, seems like a long-distant memory in 2020.

Why so? I hear you ask.

Well, there are several factors at play, but the main reason is that college tuition costs have seen explosive growth over the past 25 years, in some cases rising by as much as 440%.

Currently, over 70% of undergraduates receive financial aid of some sort to help them pay for college.

Ordinarily, more people borrowing for their education wouldn’t be too much of a problem, but unfortunately, US household incomes have been pretty much stagnant since the Millennium arrived:

Mix this in with the fact that subsidised loans (loans in which the government pays some of the interest) are also currently on a downward trend and you’ve got yourself a major crisis brewing.

As Americans are forced to pay ever-increasing amounts to get a good education, more and more students are forced to put themselves in an outrageous amount of debt for the sake of obtaining a degree.

The sad news is that because of the advent of new technologies and the number of qualified applicants applying for desirable positions, the job market in 2020 is fierce.

The job markets in many common industries are becoming increasingly more competitive which means that graduates aren’t even guaranteed to be able to secure a well enough paying job in order to pay back what they owe.

The debt levels for students are currently so significant that most graduates are likely to be saddled with it for the rest of their adult lives.

So, potential students of today face a grim choice between taking on staggering amounts of debt (which in some extreme cases can reach $100k or more) or else give up and resign themselves to the fact that they will always be in the lowest 20% of income brackets.

Given the current socio-economic climate it should come as no surprise that as we head towards the 2020s, student debt is a hot topic.

With all this in mind, here are some shocking, interesting and downright enraging statistics about student loans in the good ol’ US of A.

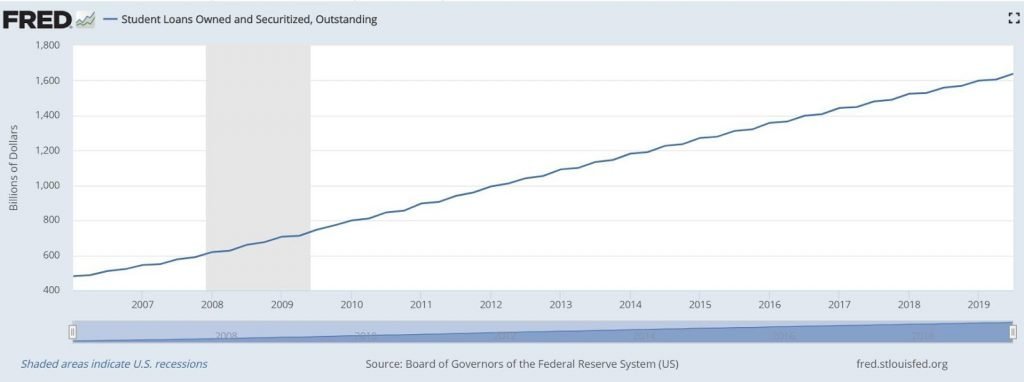

1. U.S. Student debt figures have now reached 1.6 Trillion.

According to the smart folks over at the Federal Reserve, as of March 2019, Americans now owe approximately 1.6 trillion dollars in student loans.

That’s a whole lotta moolah.

This debt category is huge and is surpassed only by Morgage debt.

Shockingly, the total amount owed in student loans in the US has more than doubled since 2009.

2. Around a third of all 18-29-year-olds in the US have student debt.

Analysis of student loan debt data conducted by The Pew Research Center has found that roughly a third of all adults in the US under the age of 30 have borrowed money to educate themselves:

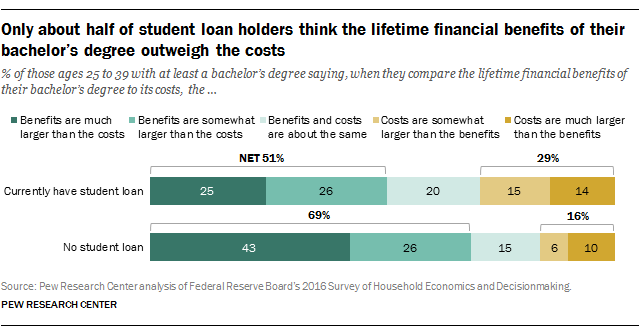

3. Almost half of all people who take out student loans don’t think it’s worth it in the long term.

The Federal Reserve board’s 2016 survey reveals that 49% of people who completed their degree think that the costs of obtaining their qualification outweigh the financial benefits.

4. If you take out a student loan, you are far more likely to struggle financially after you graduate.

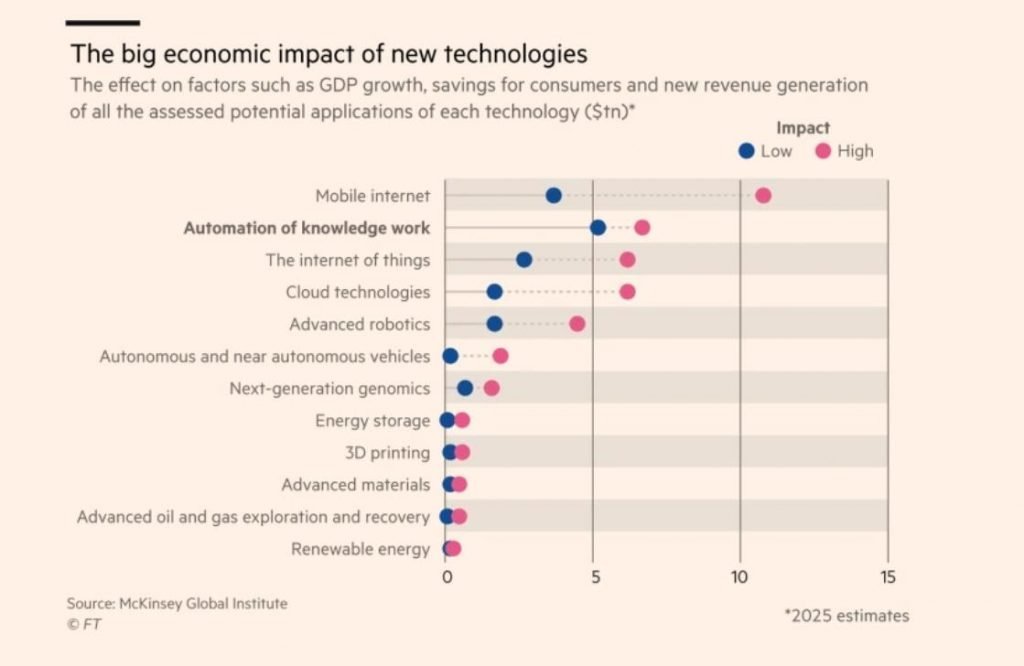

As I have touched upon at the beginning of this article, we are currently living in an age of technological revolution which is unprecedented.

New technologies, in the field of robotics and AI, for example, are being used to create more viable, cost-effective and appealing options for employers every day.

The following graph shows the estimated level of the economic impact of new technologies by 2025:

Intelligent systems, automated machinery and software are chipping away slowly but surely at common jobs like those involving office work, administration and training.

Research conducted by the consultancy firm PwC found that approximately 30% of jobs in the finance and insurance industry are likely to be fully automated by 2029.

Their research further suggests that around half of all clerical jobs across a range of other common industries will also be automated in the next 10 years.

The following graph shows the potential impact of workplace automation on jobs in six key sectors:

As the table shows, machine workers and clerical workers are currently at the highest risk of displacement.

However, big companies are preparing for the rapid advancement of automation-related technolgies that will allow them to “increase productivity” as well as their “bottom-lines”.

All this means that graduates are going to find it increasingly difficult to prove their worth to employers.

Many graduates of the near future will likely face a struggle to find work that requires skills that have not yet been mastered by machines.

With jobs for graduates becoming increasingly more scarce, many former students are already finding it difficult to secure well-paying positions.

According to data gathered by the FactTank over at the Pew Research centre, only 32% of U.S. graduates between the ages of 25 to 39 who borrowed for their education are now living “comfortably”.

This shocking statistic means that the majority of US graduates (up to 68%) could be struggling financially well into their thirties and beyond- yikes!

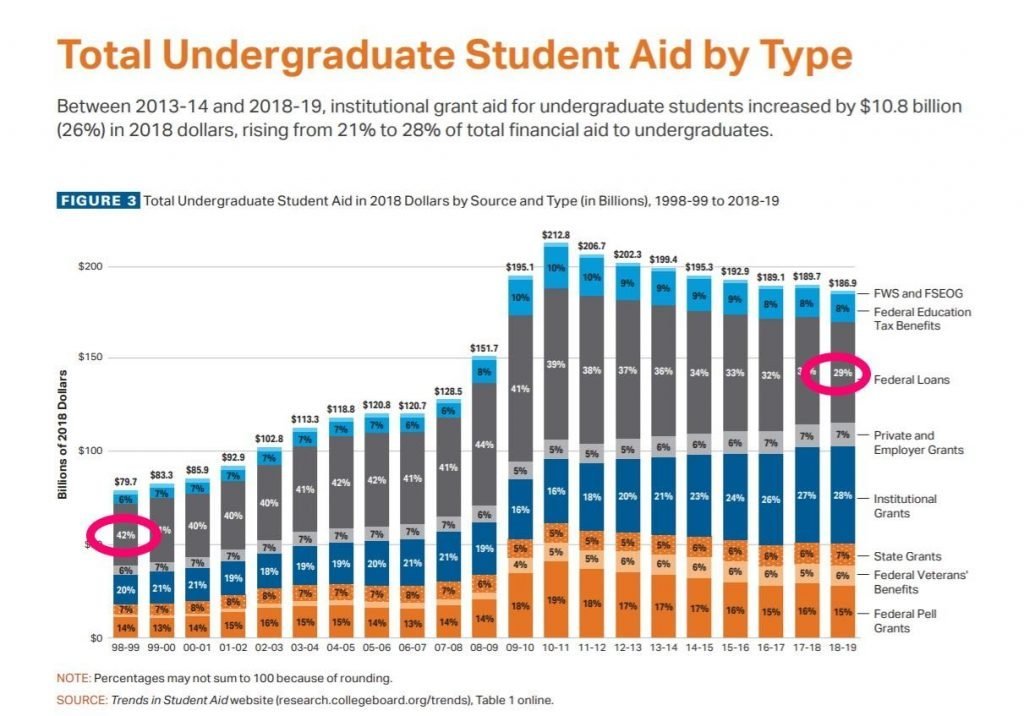

5. Fewer students are being granted federal financial aid in 2020 than ever before.

A subsidised student loan means that the government pays the interest that builds up during the period in which you study.

When it comes down to dollars and cents, subsidised student loans are the best option for US students who need to borrow.

Unfortunately, the number of loans given out that are based on financial circumstances has been declining for decades.

In 2019, only 33% of federal aid took students financial circumstances into account.

The graph shown below is taken from the Trends in Student Aid report for 2019 issued by CollegeBoard.

It shows that while state and private grants have stayed roughly the same since the late 1990s, the figures for federal loans have dropped from 42% in 1998 to just 29% in 2018 – 2019:

6. At least 20% (and possibly up to 50%) of Americans who have taken out student loans are behind on their payments.

The Federal Reserve Bank of New York has released data for the second quarter of 2019 which shows that 2 out of every 10 students are unable to keep up with their loan repayments.

They actually put the precise figure at 10.8%. However, this figure only takes into the account missed payments and does not include the following 3 categories of “delinquency” or non-payment:

- Deferment (this is where the lender has agreed to wait for payment).

- Forbearance (this is where the lender, for whatever reason, has agreed not to exercise their legal right to pursue monies owed).

- Grace periods (this is where there is a period of time where loan payments do not need to be made). Many student loans include a 6 month grace period immediately after graduation for example.

In fact, according to Investopedia, if we do take these 3 categories into account, the number of borrowers who are unable to make repayments is actually likely to be closer to 50%.

Let’s wrap this up.

So, there you have it. 6 shocking, interesting, (and potentially anger-inducing) facts and statistics about student debt.

As we have seen, rapidly rising tuition prices and growing attendance numbers are contributing significantly to student debt growth in America.

Student debt is increasing at an alarming rate and what’s even more alarming is that the job market does not appear to be able to support the number of graduates that need to find work in order to repay their loans.

Current research and statistics do suggest that getting a degree does still give you a slight advantage over your uneducated peers, but at what cost?

Whichever way you look at it, taking out a student loan in 2020 is a huge risk.

Leave a comment below on what you think is the most shocking statistic about student debts and loans?