Thinking of opening a bank account?

Confused about the difference between checking and savings accounts?

If you’re not sure which is the best choice for you, don’t worry.

We’ve got your back.

In this short article, we’ll cover what a checking account is, what a savings account is and how they are different.

So when you’re done reading, you’ll know whether to get one, the other or both.

Ready to dive in?

Let’s do this.

What is a checking account?

A checking account is the bog-standard normal account that most people have.

As the name suggests, it comes with a chequebook (and a debit card).

This type of account is designed to make it easy and convenient for you to spend money and to pay for essentials, whether you are using a debit card, mobile app or a payment service like Zelle.

What are checking accounts used for?

You can have your salary paid into your checking account, and you can also set up monthly standing orders or direct debits (also known as a “pull transaction”) to pay your bills.

Checking accounts don’t typically pay you any interest so they are not a great choice for those who have a chunk of money set aside.

Tips for opening a checking account.

There are lots of deals and incentives to open checking accounts, so if you’re thinking of opening one, make sure that you shop around and find a good deal.

Try to steer clear of “service fees”, as these monthly maintenance charges can add up over time and there really is no need to pay them.

There are plenty of options for checking accounts that don’t have any of these monthly fees attached, so keep looking till you find one!

A good checking account should offer low or, even better, no monthly fees and should also offer free access to national ATM networks.

If you do a little bit of research, you should be able to get yourself a little sign-up bonus, too!

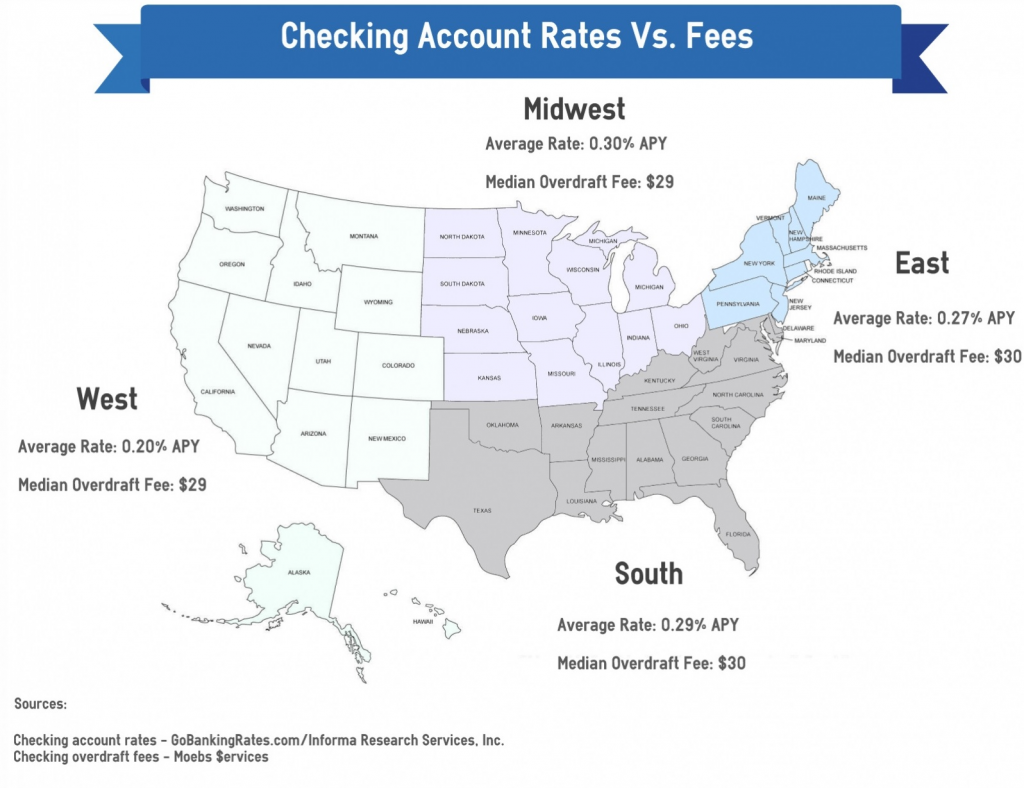

Will I have to pay any fees?

As mentioned above, you should be able to find a checking account that has low or even no monthly fee.

A word of caution. Checking accounts usually have high penalties attached.

If you go over your limit or fail to maintain an agreed-upon minimum balance, you will incur hefty fees.

This is because checking accounts don’t have large sums of money in them for long periods of time, which means that the bank can’t lend out your money.

Instead, they make money from charging fees for everything from foreign ATM use to administration costs.

What is a savings account?

As the name suggests a savings account is an account designed for saving money.

If you have a decent chunk of cash set aside for a rainy day, you should keep it in a savings account instead of a checking account.

Why?

Because savings accounts offer higher interest rates, which means that if you put your money into a savings account, it will make you more money.

What’s the downside?

That’s a smart question.

The downside is that you can’t get your hands on your money as easily and quickly.

How do savings accounts work?

The whole idea behind savings accounts is that the money stays in the bank for long periods of time.

This makes the bank happy because they can then lend money to other people based on your savings amount (and charge interest).

Most savings accounts limit the number of transactions (6 per month is the norm) that you can complete for this reason.

It’s likely that you won’t get a chequebook or a debit card, so you will have to either withdraw from the bank directly or transfer funds into another account.

Many people have both checking and savings accounts and set up regular transfers from their checking accounts in order to increase their savings.

Savings accounts are designed to make it harder for you to spend, and they often incentivise you to keep your money in the account.

Some also have penalties for early or frequent withdrawal.

Do I have to pay fees with a savings account?

Unless you go over your transaction allowance, you shouldn’t incur any fees from your savings account.

This is because the bank makes money from lending based on your investment with them, so they rarely charge fees.

Instead, they reward savers by giving them high-interest rates.

Plus, because there are far fewer transactions for the banks to monitor, this type of account typically costs them far less to maintain, which is another reason fees on savings accounts aren’t really a thing.

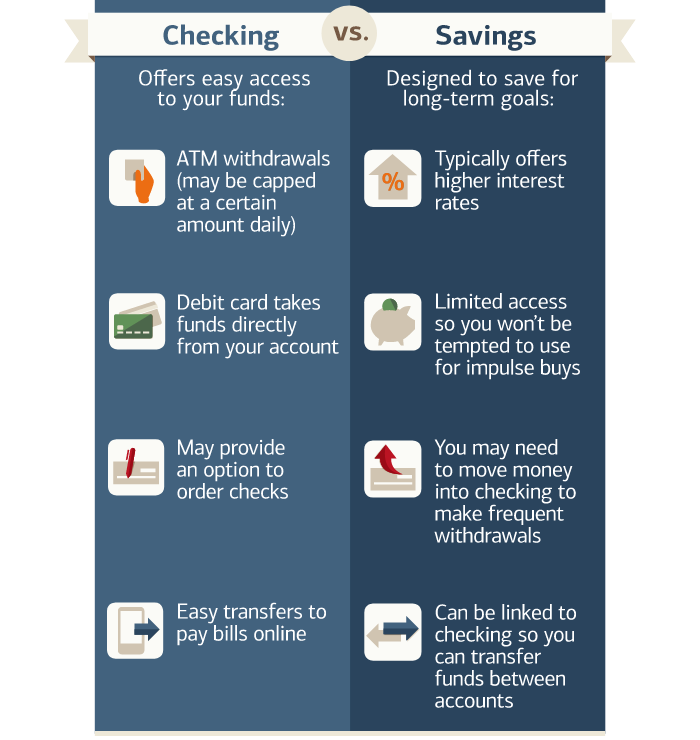

Conclusion: What’s the difference between a checking account and a savings account?

Let’s go over the key differences between checking and savings accounts.

- Checking accounts are designed for spending. Savings accounts are designed for saving.

- Checking accounts give you easy and frequent access to your money. Savings accounts limit the number of transactions you can do to around 6 per month.

- Checking accounts have lots of fees and penalties attached. Savings accounts rarely charge fees.

- Checking accounts pay no interest. Savings accounts pay interest and make you money.

- Checking accounts make it easy to receive a salary and to pay bills. Savings accounts do not.

I hope that you have found the information in the article useful and good luck with the search for the perfect account for you!