Thinking of leasing a car?

Confused about what is the required minimum credit score to lease a car?

Don’t worry, ‘cause we’re about to break it down.

We’ll drive you through what you need to know about leasing and how credit scoring works.

Once you’re done reading, you’ll be able to decide if leasing is the right road for you to go down.

Ready to get started?

Good.

Hop in, fasten your seatbelt and let’s roll.

How does car leasing work?

When you lease a car you are basically renting it.

The process is similar to renting a house or apartment. You put down a deposit, then pay a monthly fee for as long as you keep the car.

Most car lease contracts are long-term. The average time period is 3 years, though leases can run for longer.

It’s a good rule of thumb to lease the car for the duration of its warranty, as after that you will be responsible for any maintenance costs.

The major difference between financing and leasing is that you do not legally own the car when you lease.

You will be expected to look after the vehicle you have leased and to stick to any lease conditions such as mileage allowances.

Unlike an apartment rental, car lease agreements generally give you the option to either purchase or to return the vehicle at the end of the agreed lease period.

Be aware that most dealers will thoroughly inspect the vehicle when you return it and you may be charged for repairs if there is any damage or excessive wear and tear.

Minimum Credit score to lease a car in 2020.

Credit scores typically range between 300 and 850.

If you want to lease a car and you already know your current credit score, you can check your chances of being accepted against your score quickly and easily using the chart below:

As you can see, if you have a credit score of 710 or above its highly likely that your lease request will be accepted.

As we move further down the scale, the chance of being accepted decreases slightly.

However, most people still have a good chance of being granted a lease provided that they are not in the poor or very poor categories (a score of 600 or below).

The typical minimum score to lease a car is 601, as this is the point at which you cross over from the “poor” category to the “fair” category.

Auto lease rates by credit score.

Did you know that your credit score can also affect the interest rate of your car lease?

Well, it most certainly can.

The higher your credit score the better deal you can get.

This may not seem like it, but it can actually be good news for those with lower credit scores as it means that you may still be accepted if you are willing to pay a bigger down payment and a higher interest rate.

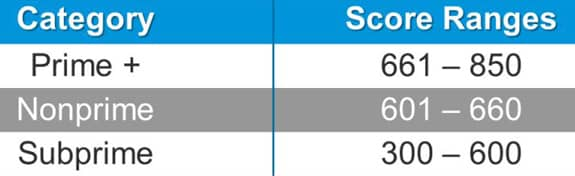

The financial experts and lenders in the car leasing world break credit scores down into the following 3 categories:

- Prime

- Non-prime

- Subprime

You can see these 3 ratings alongside their associated credit scores below:

Let’s look at these 3 categories in a little more detail and see what they mean in terms of you getting a good deal on your car lease.

- The first category is called Prime plus.

If you have a credit score that falls between 661 and 850 then you will be classified by lenders as a Prime plus customer.

What does that mean?

It means that you are the type of customer that your dealership values most.

If you are a Prime Plus, you are seen as low risk and are considered pretty much a sure thing when it comes to repayments.

If you are in this top category you should negotiate hard, particularly if your score is 740 or higher, as it’s highly likely that you will be given the best possible deal.

- Non-prime borrowers are those with credit scores that fall into the 601 to 660 bracket.

If you’re classed as non-prime it means that you are still seen as a pretty safe bet by leasers.

You should have no problems getting approved and (depending on where you fall on the scale) you should be able to get a competitive deal on your lease.

The lower your score within this bracket, the more likely it is that your interest rates will increase. So be prepared to pay a higher interest rate if your down near the bottom (under 620).

- Sub-prime borrowers are those with credit scores of between 600 and 300.

If you fall into this third category, it means that you are classed as high risk.

This doesn’t necessarily mean that you won’t be able to secure a lease.

You can increase your chances of being accepted by offering to pay a higher downpayment and by increasing the monthly payment as high as you can afford.

Also, there are several speciality lenders who can assist you in securing a lease.

But, be aware that if you have a low credit score and you do manage to find a lender willing to work with you, it will cost you a lot more.

Final thoughts: Can you lease a car with bad credit?

The short answer is yes, you can.

But whether or not you should is a different matter.

While there are lenders out there who specialise in offering leasing agreements to those with low credit scores, as we have discussed the deals they offer are likely to be the least competitive on the market.

Leasing an older car may also be an option for those with low ratings, but with older cars comes an increased likelihood of shelling out for repairs and maintenance.

What all this boils down to is that if you have your heart set on leasing, you’ll have to pay more.

There is an upside though because leasing a car can actually help you to improve your credit rating.